12 Months of Random Walk

The year in macro and capital markets, as told by a year of Random Walk

Random Walk recaps the year, month-by-month, with the posts that tell the story.

👉👉👉Reminder to sign up for the Weekly Recap only, if daily emails is too much. Find me on twitter, for more fun. 👋👋👋Random Walk has been piloting some other initiatives and now would like to hear from broader universe of you:

(1) 🛎️ Schedule a time to chat with me. I want to know what would be valuable to you.

(2) 💡 Find out more about Random Walk Idea Dinners. High-Signal Serendipity.12 Months of Random Walk

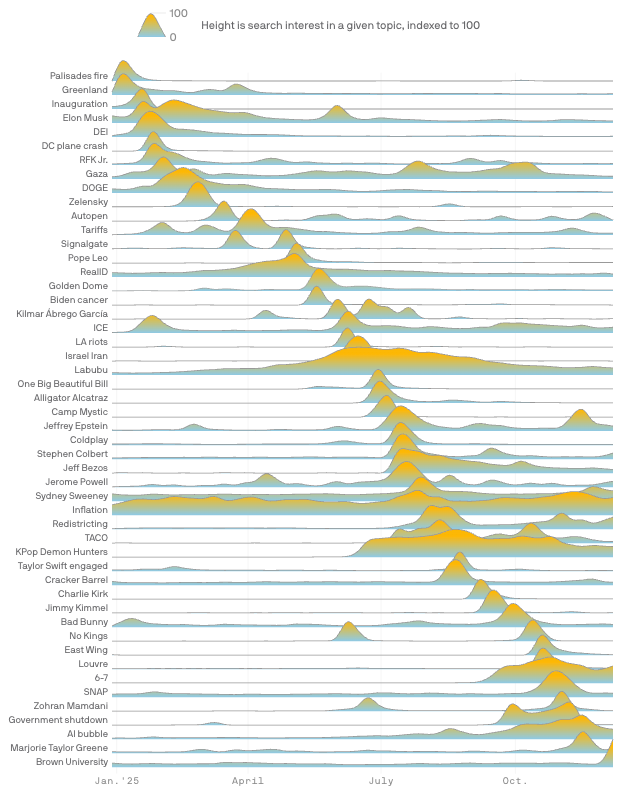

This is the year, as told by the news cycle:

If you told a loved one in 2020 that, in five years, Labubu and TACO would be the most important things to know, you might have lost a loved-one.

More importantly, below is the year of 2025, as told by Random Walk.

It was a good year, mostly of predictions coming home to roost.

There were some tariff and uncertainty freakouts (followed by some dip-buying), an emerging new cycle in private markets, the ongoing reality of growth without growing, and, of course, AI bubbling, hot! hot! hot!

Thanks for following along.

January

Paying top dollar, because no price is too high

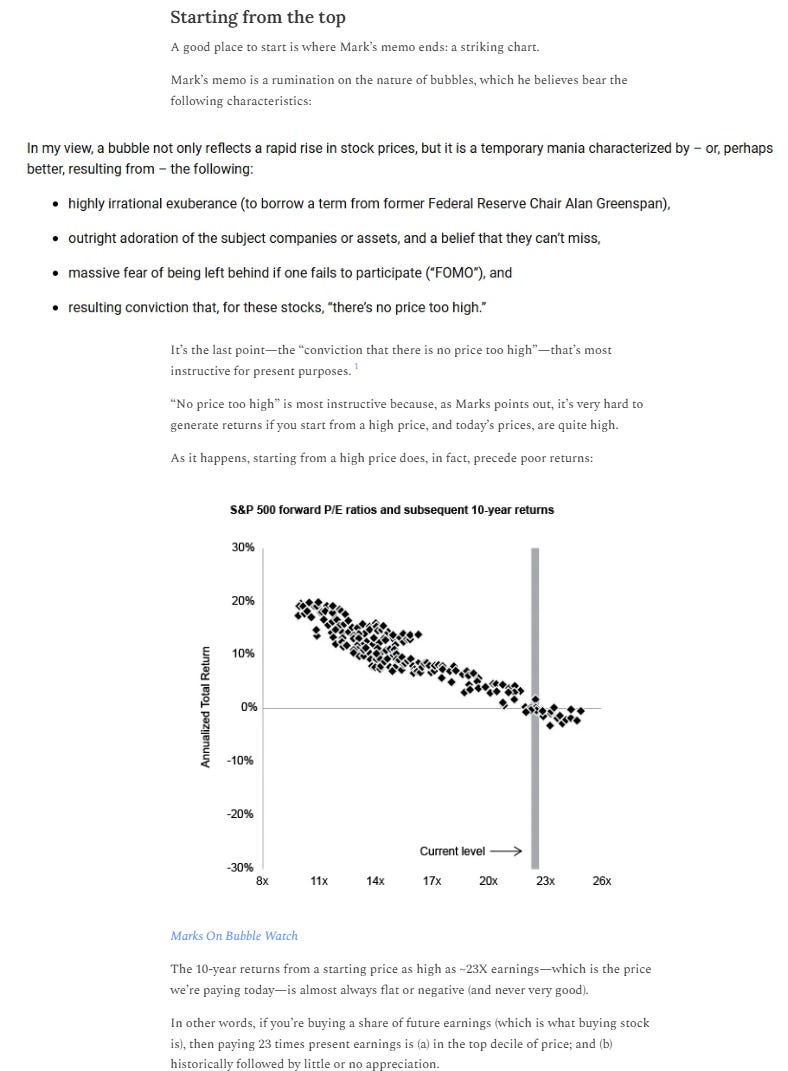

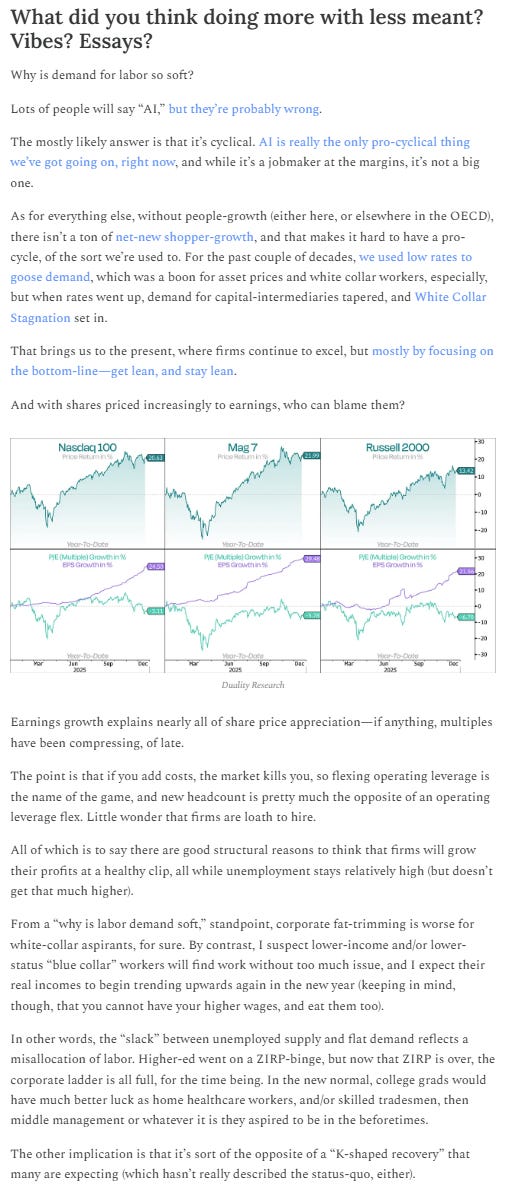

Because everyone has AI Bubble or Not? on the mind, the legendary Howard Marks offered a simple observation about the relationship between returns and starting prices:

When forward multiples are high (as they are now), future returns tend to be low.

It makes sense. That’s why the expression is “buy low, sell high” and not “buy high, sell higher.”

So, the stock market has to go down, right?

Well, not exactly. Because earnings growth is also historically high, and margins are getting fatter. Not coincidentally, that’s also (likely) why multiples are so high—because earnings growth (and margins) are so high.

Even if multiples (i.e. valuations) stay exactly as they are, profit-growth alone would be enough to drive stock prices higher. And so they have. In fact, multiples have compressed of late, and market returns are still positive because EPS keeps on growing.

Runners up:

Power generation is fine. It’s transmission that’s the problem

Higher rates make companies lean, mean, profit-generating machines & Higher rates have made firms stronger, and more improvements are on the way

ICYMI

February

People are worried about labor market breadth

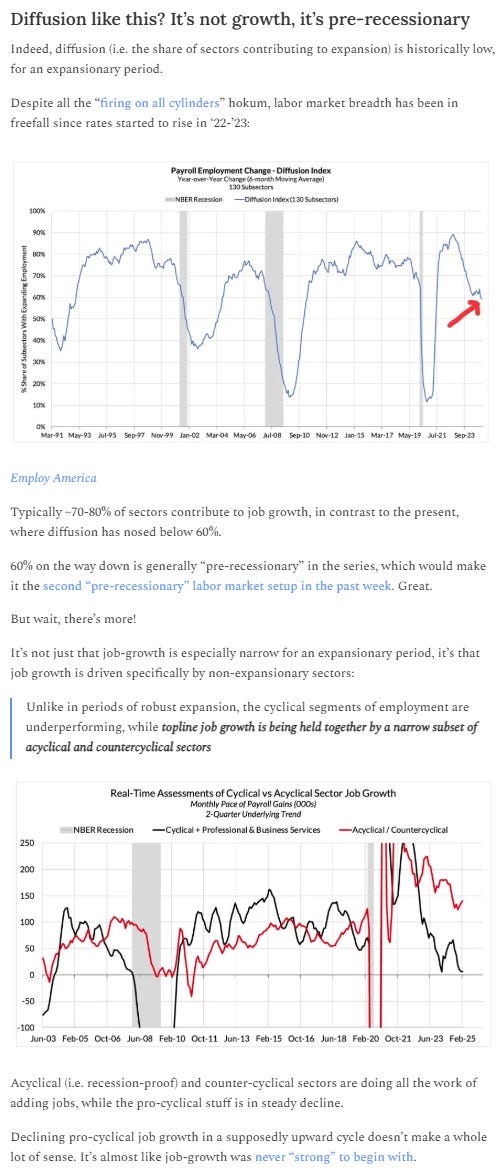

Random Walk spent a lot of ‘23-’24 pointing out that the economy (broadly speaking) was not “strong.”

The job market especially, was not strong. It was tight because of a pandemic-driven pull-forward of retirement, but if you looked closely, you’d notice that all the the job “growth” was actually job “recovery.” In fact, the only bang-up sector was healthcare, and we already know that healthcare growth isn’t really “growth,” so much as unsustainably-financed elder care.

That prompted the obvious question: what happens when we’re all caught up?

By 2025, Random Walk wasn’t the only one noticing the “narrowness” of the labor market, aka “Healthcare makes all the jobs.”

The lack of labor market diffusion, driven as it is by acyclical sectors, i.e. healthcare, is historically not a picture of strength.

As it turns out, job-growth has continued to be sparse . . . but it hasn’t mattered as much as it ordinarily would because people-growth has also been sparse.

Still, it bears repeating that tech (but really AI) is the cycle now. With the OECD contracting, it’s harder to grow consumer TAM—you can’t sell more phones, cars, houses, etc. without more people to sell them to. Software, though, still has more of the world to eat.

Runners up:

March

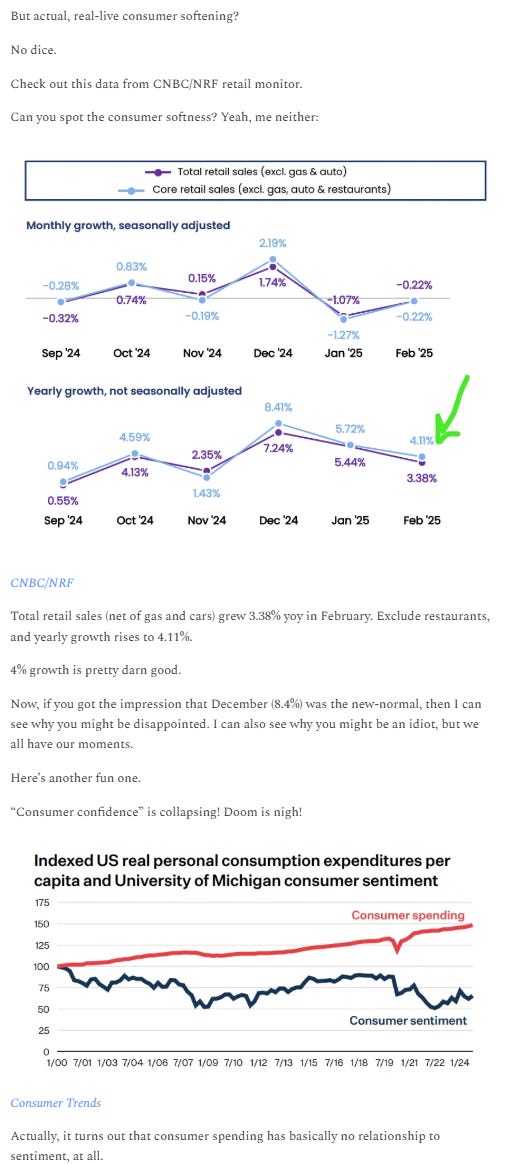

Prices say panic, but the data says others (even more cont.)

March 2025 was the onset of the Great Tariff Uncertainty Crisis that brought the stock market crashing down.

It was all an illusion.

Sentiment may have been “panic,” but the data was “full steam ahead.” Or, at least, as much steam as we had before:1

No, consumers were not going soft, no matter how much doom the chattering class was inclined to spread.

Q4 of ‘24 was an unsustainable “Trump Bump” that made Q1 (and comps) look bad, but everything under-the-hood was obviously fine, or rather, fine as it ever was.

Hopefully you bought the dip.

Runners up:

April

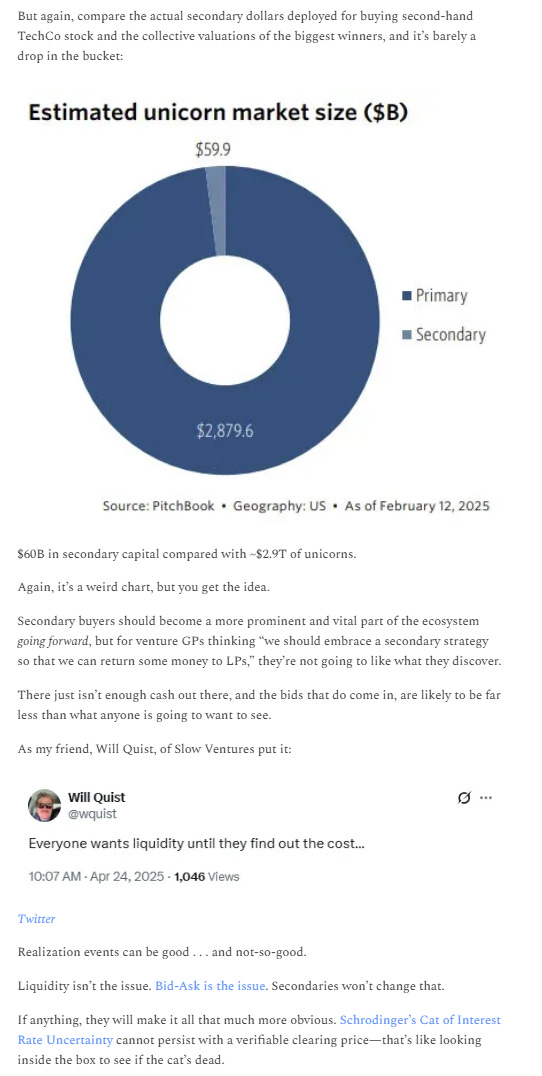

Secondaries will not save VC (and 8 other charts from VC-land)

There was a moment when secondaries were going to be the great solve for the VC version of “no exits for private capital.”

While secondary markets ought to get deeper and more liquid (and they already are), (a) they’re still a drop in the pail compared to the broader universe of VC-backed enterprise value; and (b) they’re no remedy for wildly over-priced investments and/or investments that never should have been made.

Reality then, as it is now, is that the previous cycle is, for the most part, a dud, and it’s far better to come to grips, and embrace the new cycle, than cope for a rescue that ain’t coming:

Exit markets have never been closed. The Bid-Ask is just too wide.

Anyways, things have played out as expected. Returns for older vintages continue to lag, and most of the exit activity has come via consolidation and startup M&A, where curiously no one shares the price.

Rather than saving older investments at a discount, secondary dollars have mostly concentrated at the top (and trade at hefty premiums).

Runners up

May

No, AI is not taking white collar jobs

Whether AI will “take jobs” in the future, is an open question.

Random Walk’s view is that it will take jobs, but it will also make jobs. I’m biased towards great productivity leaps forward, what can I say.

As for whether AI is taking jobs, right now? I think the answer is pretty clearly “no,” certainly not in comparison to the jobs that it’s making. Given all the investment in AI and AI-adjacent, it’s the best/only pro-cyclical thing we’ve got going right now (and therefore a job-maker, not a job-taker).

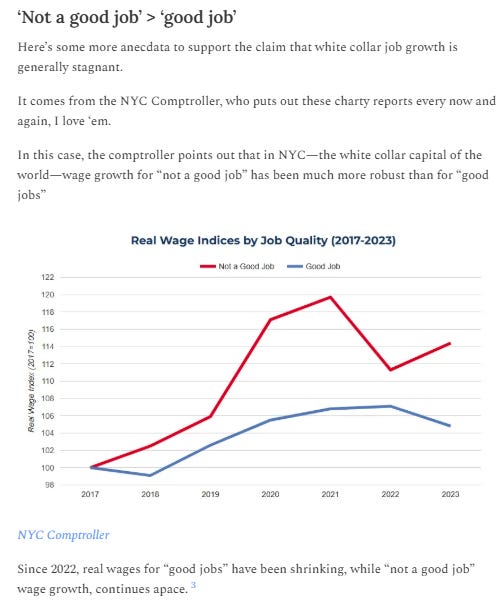

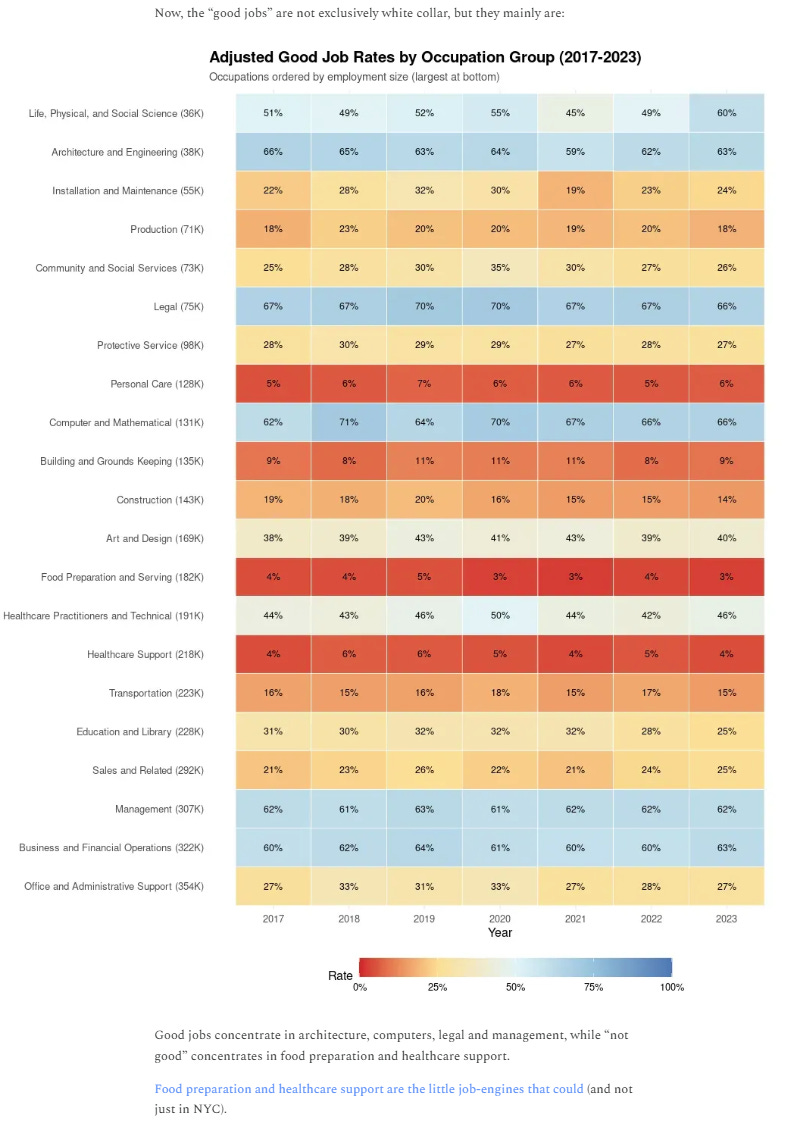

So, why is the hiring market so grim for white collar types? Well, it’s cyclical:

“AI is taking white collar jobs” is a thing people are saying, but they’re very probably wrong.

The claim focuses on the increasingly difficult hiring market for entry-level white collar workers, recent college grads, MBAs and the like. The observation is correct—it is hard for new- and re-entrants to the job market (and hiring is generally slow)—but it’s been correct for a while, and you’d probably only attribute it to AI, if you only started paying attention recently.

So what is putting pressure on white collar hiring?

Random Walk isn’t going to rehash the whole thing right now, but the gist of my theory is White Collar Stagnation (which is a byproduct of No Exits for Private Capital). Tl;dr, if the “knowledge economy” (and its biggest paydays) are linked to the intermediation of capital, then when capital got (and stayed) relatively scarce, the knowledge economy jobs (and its paydays) would get scarce, as well.

I can’t prove it, but it makes sense, it’s been my theory for a while, and it shows up in the data. Plus, becoming a lean, mean profit-generating machine is generally not associated with lots of hiring (at least not at first).

The other thing to note is that the end of the White Collar tailwind (i.e. free money) preceded the end of the Blue Collar tailwind (i.e. the Labor Shortage) by ~1 year.

But now both tailwinds are over, albeit for different reasons, and hiring is slow for everyone, and AI ain’t got nothing to do with it.

White Collar Stagnation is a real thing that pre-dates AI, and is a function of higher costs of capital (and less of a premium on capital intermediaries, i.e. white collar workers).

Random Walk has collected various data and anecdata over the past year to make the point that AI is a job-maker, not a job-taker, but this was my favorite chart from the post.

Courtesy of the NY Comptroller’s office, behold the relative rise of lower-paying “not a good job[s]”:

Wage growth for the “not a good job” category, and job-growth, too:

When the white collar capital of the world has taken 5 years to breakeven on white collar jobs, I don’t think you can blame AI.

Anyways, that’s my story, and I’m sticking to it, until I see some data that would demonstrate otherwise.

Runners up:

June

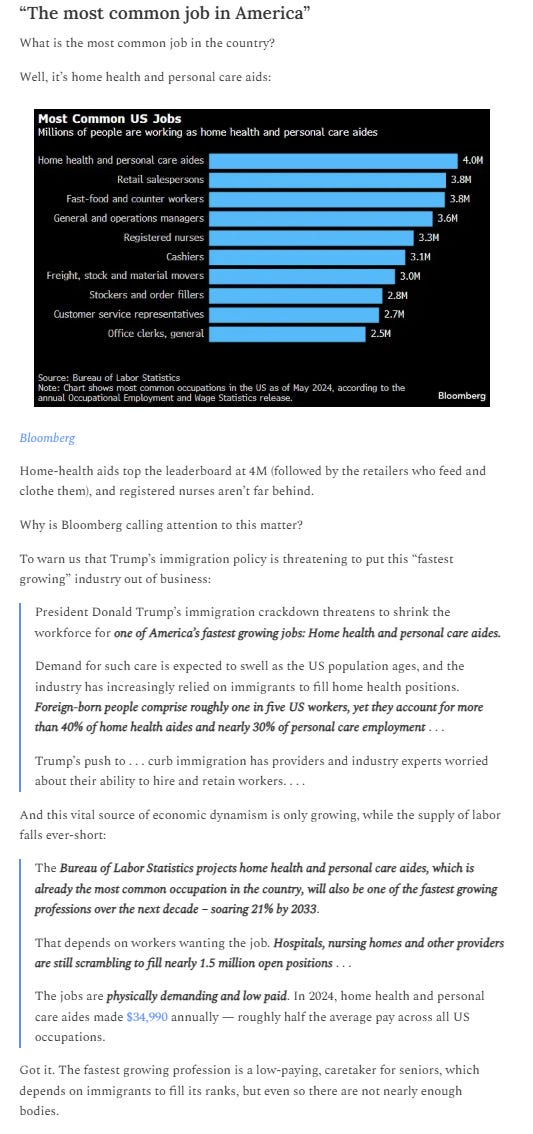

Rotation to the National Nursing Home is running out of Foreign Born workers

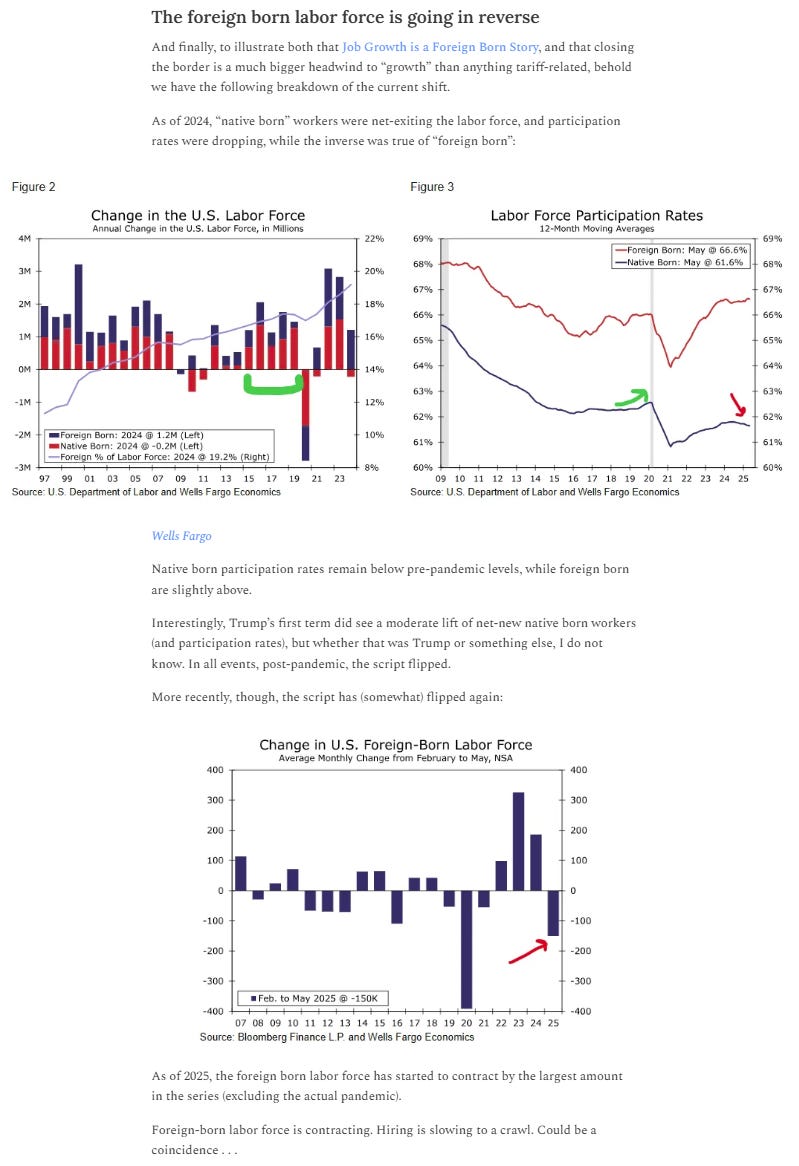

If you didn’t grok that “job growth” was a foreign-born story, then you might have been caught off guard when a closed border brought job-growth to a halt.

Well, not exactly—job growth would inevitably taper once the catch-up was complete—but without the steady influx of lower-income service workers, flowing especially into Uncle Sam-sponsored healthcare roles (and the retailers and restauranteurs that feed and supply them), it would taper even more dramatically.

And so it has. Employers would have to do more with less (and so they have).

The fastest growing job in America? Home healthcare aids, which also happen to be a favorite of the more recent vintage of Americans (and in the news lately, for not such good reasons).

With a new sheriff in-town, the rise of Uncle Sam’s Immigrant Nursing Brigade, is suddenly worth noticing.

As for the labor force more broadly?

Not a coincidence, indeed.

To be fair, take this data with a grain of salt because “foreign” v. “native” born gets squishy when self-reporting is involved, but regardless of the quantum of slowdown, we know there is most definitely a slowdown.

Runners up:

More with less is the only thing that matters (and 9 other labor market charts)

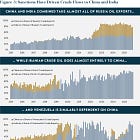

‘China is losing the trade war’ is probably true, but also irrelevant

July

Man, July was a good month. So hard to choose.

Search is dying, long-live Google!

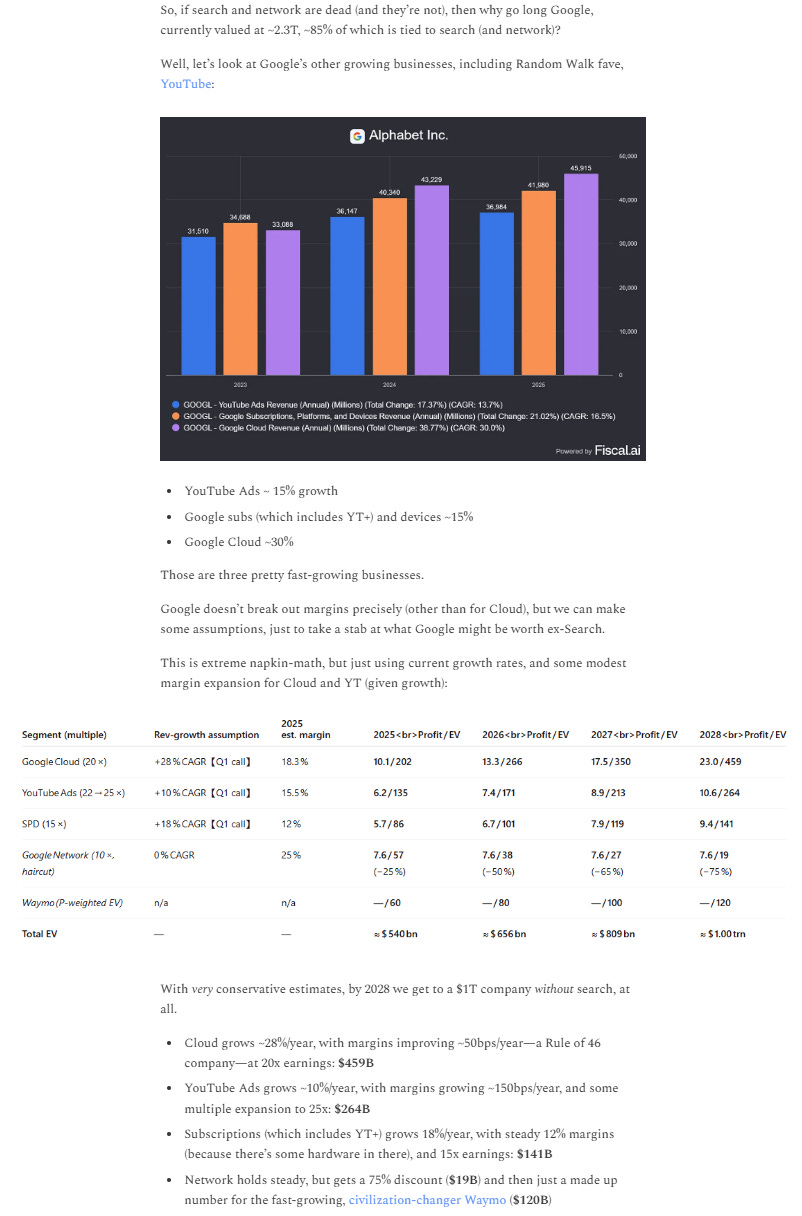

Wherein I make the case that Google GOOG 0.00%↑ is a $1T company even if you mark search down to $0 (which would be a very stupid thing to do).

This was during the peak “google is dying,” hysteria, and one of those rare moments to snag a generational company on the cheap.

Add it all together, and by 2028, Google GOOGL -0.62%↓ is a $1T company, using some very conservative growth and valuation assumptions, even if the value of the greatest business ever built gets marked to $0 in just three years.

That $1T also assumes:

no additional AI lift for cloud (or deceleration tbf), and that a Rule of 46 company gets only a 20x multiple (v. 25x for Azure, and 31x for AWS);

no value for all of google’s other various businesses, including the nascent chips business for inference, quantum breakthroughs, and fiber networks;

youtube stays under-monetized (with steady 10% growth, and industry-leading creator payouts), instead of getting something closer to netflix and/or instagram.

And again, $1T in EV assuming that search goes to 0—which has a likelihood of basically 0—instead of, y’know, google figuring out how to turn AI Search into a money-maker, and/or otherwise becoming a winner in this AI-game in dozens of other ways.

That was back in July.

Now Gemini is considered the lead AI dog (for now), and Google’s TPUs are the cat’s meow.

Runners up

August

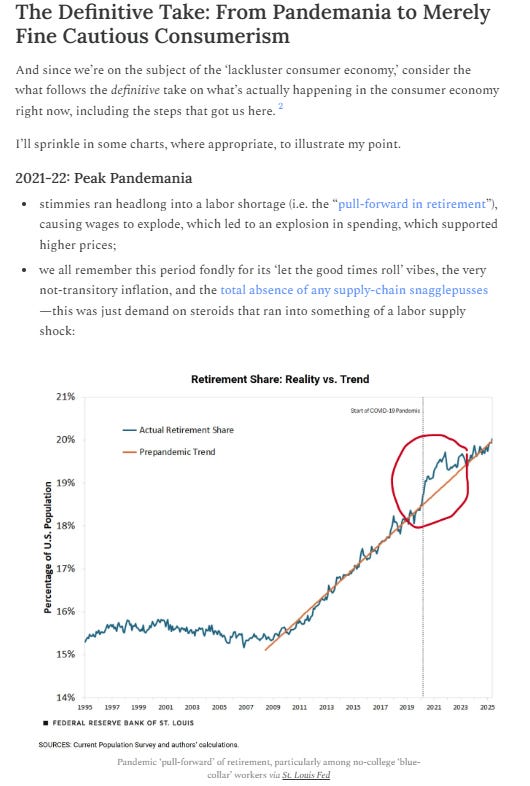

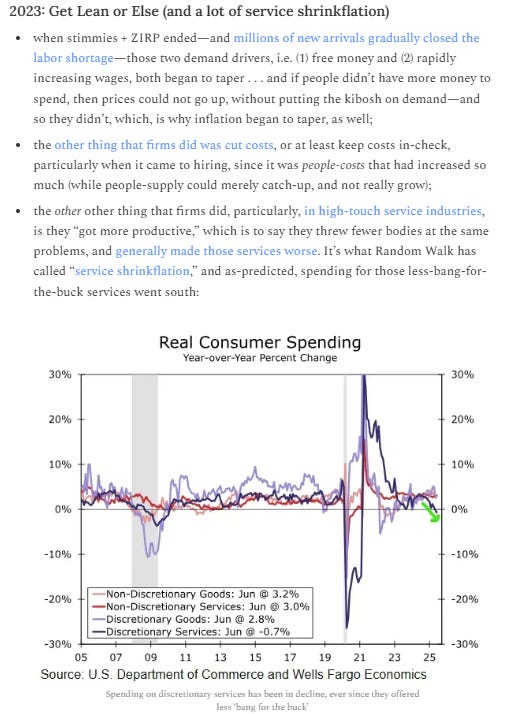

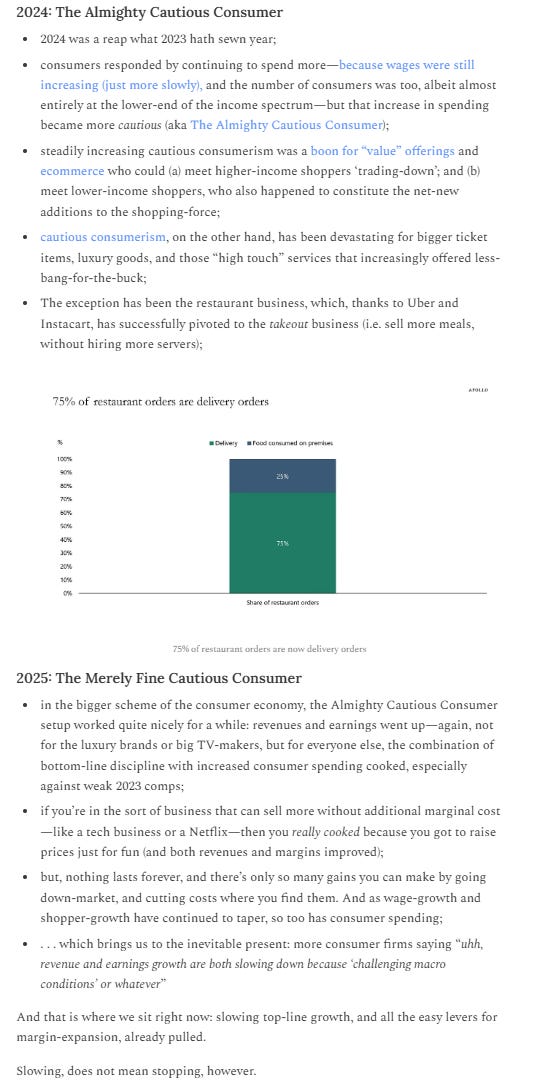

The definitive take on the current state of the Somewhat Less Mighty Cautious Consumer

I got annoyed at the world for fawning over Derek Thompson’s belated attempts to describe the world according to Random Walk, when of course, the world ought to be fawning over me.

The boom, bust, and cautious march forward of the Almighty Cautious Consumer has been a steady drum-beat around these parts.

For all the various noise around “consumer slowdown!” and/or “K-shaped [everything]” there’s been plenty of signal if you pay attention to who is earning more/less money, for what reasons, and what effects that has on what and how people consume.

Value? ecomm (and BNPL)? Yes. Crappy, overpriced shrinkflated services? No. Big, expensive financed stuff? Also, not much.

But the Almighty Consumer keeps plugging along, buying cheap tchotchkes on the internet, and hunting for discounts.

Runners up:

September

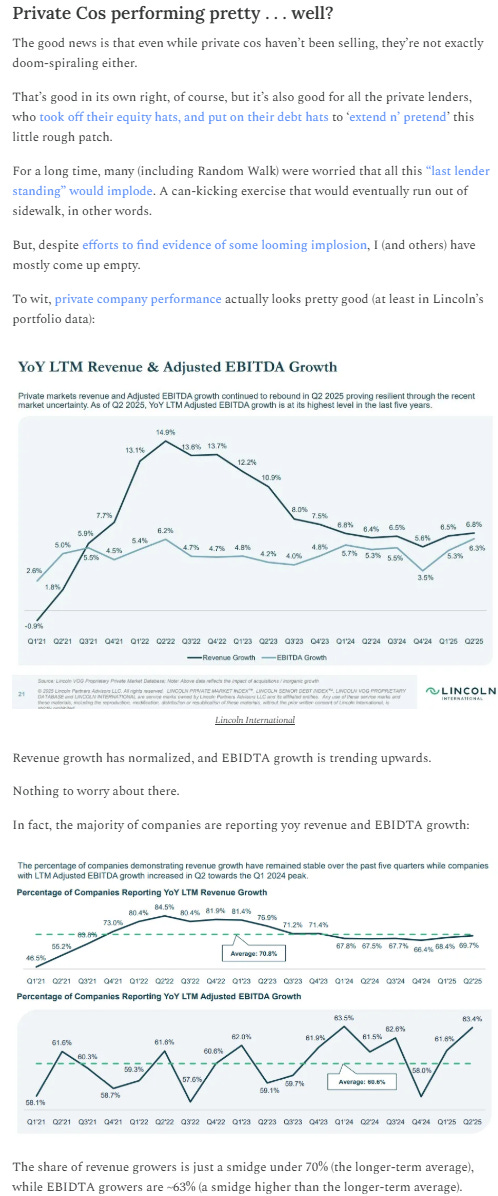

Of Private Cos, and Private Credit

There were some posts that were more read, shared, and liked than this one, but the fact of fundamentally sound private co and private credit performance has been a long-running theme.

Performance may not be strong enough to fetch exit multiples worth exiting for, but there’s been no evidence of eminent doom, either.

Performance has been solid, if unspectacular, for the private co universe and that’s nothing to lose sleep over.

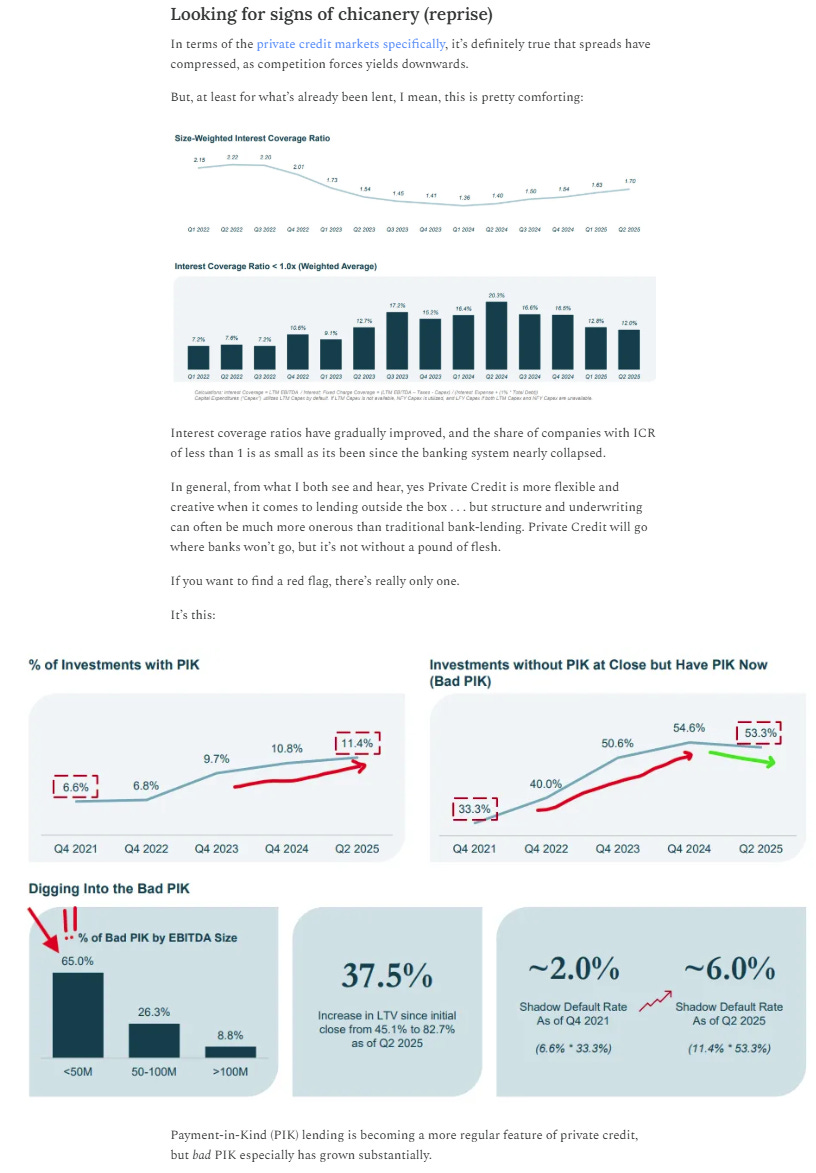

Signs of chicanery underneath the hood?

There’s been very little that I’ve been able to observe, at least.

Bad PIKs and FABNs do some rhyming with history, for sure, but there’s always something for the jaundiced and askanced.

Runners up:

Someone else pay for my healthcare is probably the worst idea ever

For VC, the song remains the same, which is why it’s totally different now

October

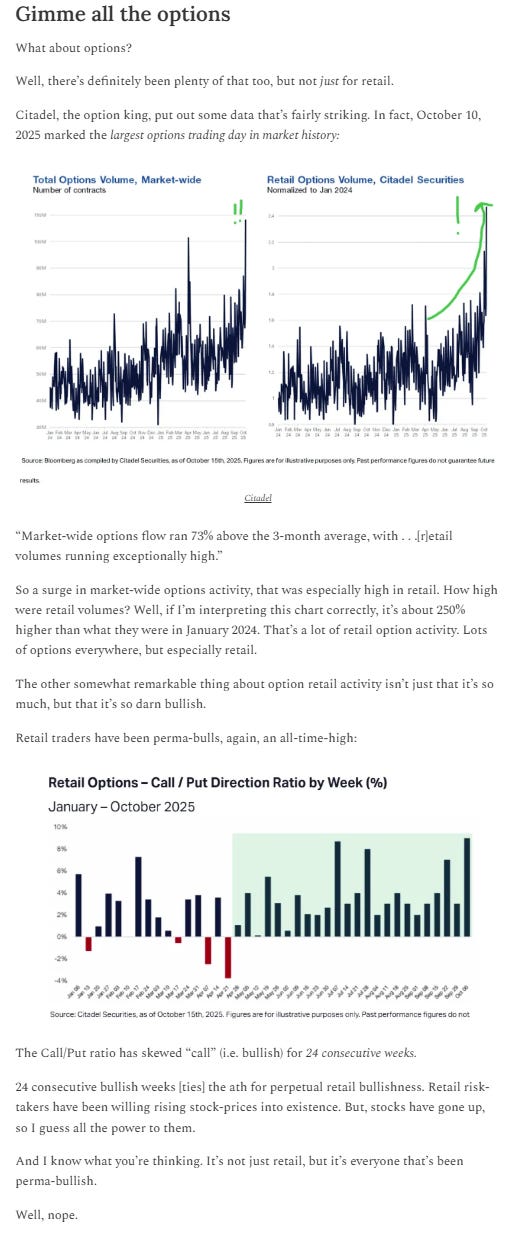

Is retail the smart money now?

I wouldn’t call this a major theme of Random Walk’s, but it’s still a major theme.

Retail participation in the stock market is a big deal now. Retail is doing historic levels of trading (and option-trading, especially), and retail moves markets, for better or for worse.

Retail is bullish. Very bullish.

The reality is that while fundamentals still drive performance in the longer run, narrative (good and bad) can really drive performance in the shorter- and medium-runs.

Things are expensive, but occasionally the narrative blinks, and smart money swoops in. Or maybe that’s the dumb money, buying dips?

It’s hard to keep track.

Runners up:

November

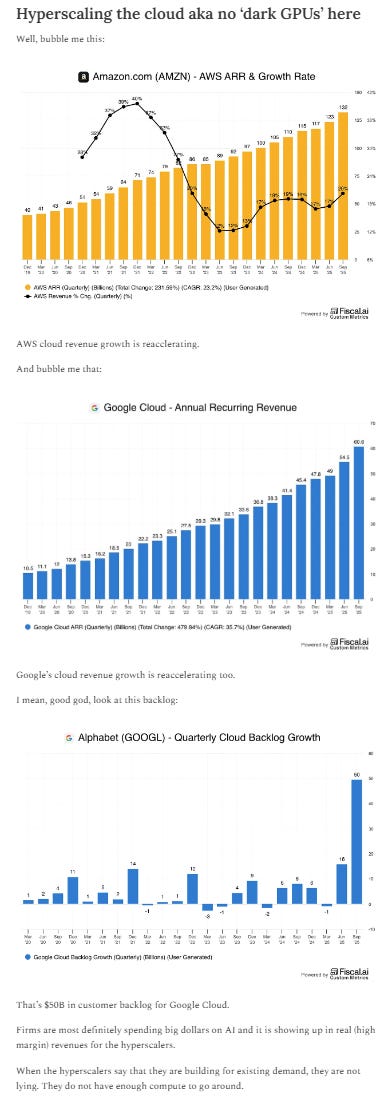

AI’s bubbling (hot hot hot)

‘AI Bubble or Not?’ has definitely been a theme for the past year, but it hasn’t featured prominently in this recap, for whatever reason.

Anyways, this one is pretty straightforward.

The point is that the companies spending a lot of money on AI aren’t spending because customers might want their AI compute later. Customers want it right now.

If ‘Dark Fiber’ was a defining feature of the Dotcom bubble, there is no analogue to dark compute.

There might be some dark data centers waiting for hookup to the grid, that’s kind of a thing. But GPUs are melting before they’re being left dormant.

Plus, retention curves are smiling, and supply-and-demand are (for now) waltzing into Jevons paradise, whereby cheaper supply of compute, begets even more demand for compute.

Runner’s up:

December

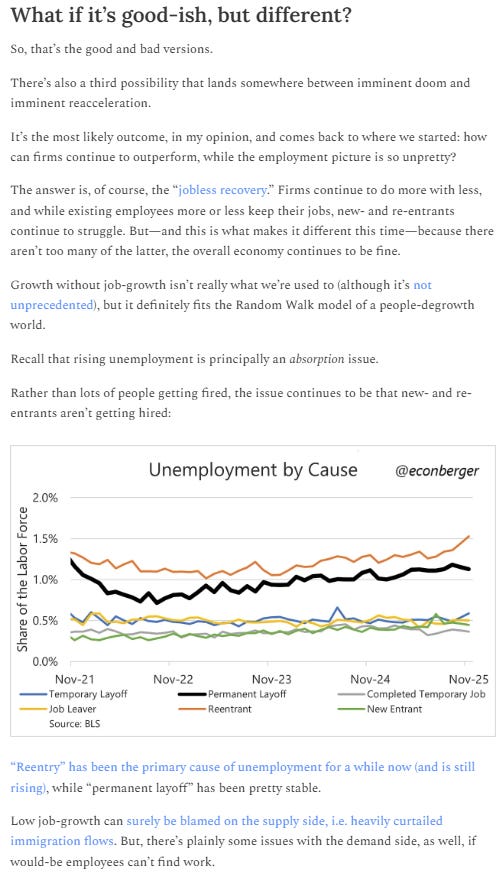

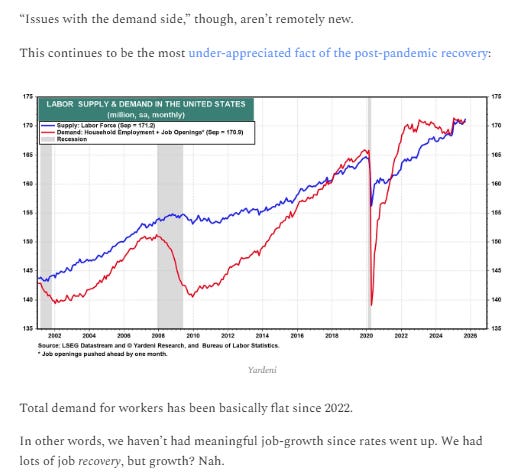

Slow descent or ready for takeoff?

Much of the investment strategy universe seems inclined to frame their respective 2026 outlooks as a binary: total collapse or rip-roaring future?

Whether they actually think in those terms, or they’re just doing it for the clicks, who knows, but in Random Walk’s view, the boring, but most likely correct answer is: something in between (but unlike anything we’ve really seen before).

For now, we’re making good in a low people-growth world, with a decent helping of transformational technology on the side.

Plus, the most under-appreciated fact of the post-pandemic “recovery”:

Job-recovery, but not growth.

Anyways, good-ish, but different.

Tech is the only cycle now, and it couldn’t have come at a better time:

Doing more with less, is the name of the game.

With more stimmies inbound, and monetary loosening underway, plus a broader economy already with a few years of driving in ‘neutral’ under its belt, I think there’s more risk to the upside, than downside. Valuations can be fickle, however.

I do worry a bit about that rising long-term unemployment, and whether White Collar Stagnation eventually comes home to roost, but for now, the world will run on short-form video (which pays for all the supercompute that the world will run on soon enough).

Runners up:

Previously, on Random Walk

Private Credit and Insurance, two peas in a pod (reprise), and a chart dump on default rates

five charts on the rise of private credit in life insurance

Energy in 1776

It’s July 4th, so Happy Birthday America, and we’re going to keep it light and only semi-topical.

Random Walk is an idea company dedicated to the discovery of idea alpha. Find differentiated data, perspectives and people, and keep your information mix lively. A foolish consistency is the hobgoblin of small minds. Fight the Great Idea Stagnation. Join Random Walk. Follow me on twitter. Follow me on substack: